Making Digital the Default in Pakistan's Cashless Agenda

From Transaction Scale to Everyday Digital Spending

Executive Summary

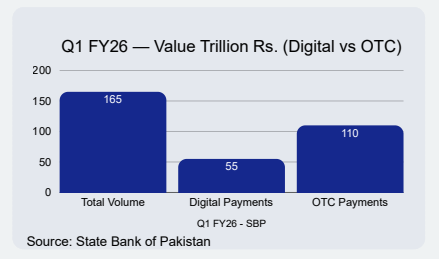

Pakistan’s retail payment ecosystem has reached national scale. Digital payments now dominate transaction volumes, driven largely by mobile banking and wallet-based channels. This reflects years of sustained investment in digital infrastructure, regulatory reform, and ecosystem development. However, while digital has scaled by volume, cash and over the counter (OTC) channels continue to dominate by value. In Q1 FY26 alone, OTC channels accounted for approximately PKR 110.4 trillion in retail payment value, compared to PKR 55.4 trillion processed through digital channels (State Bank of Pakistan). This indicates that the challenge facing Pakistan’s cashless agenda has evolved. It is no longer primarily about access or payment rails, but about whether digital payments are becoming the default for everyday economic activity. The persistence of cash reflects a set of interlinked structural and behavioural constraints. Digital inflows often do not translate into digital spending, acceptance at everyday points of commerce remains uneven, last-mile operational frictions reduce reliability, and trust and usage habits are still forming. To move from scale to sustainability, the next phase of Pakistan’s cashless transition must focus on converting digital adoption into durable, everyday use. This requires targeted action across user journeys, merchant acceptance, infrastructure reliability, trust mechanisms, and incentives that shape behaviour.

Pakistan’s Payments Ecosystem at National Scale

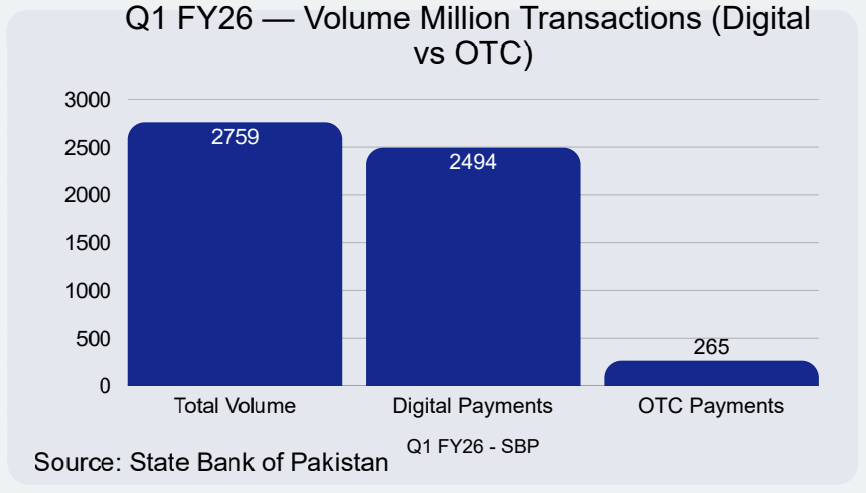

Pakistan’s retail payment ecosystem is now operating at national scale. According to the State Bank of Pakistan, in Q1 FY26, 2.5 billion payments were processed through digital channels, representing around 90 percent of total retail payment volume, up from 87 percent in the same quarter of the previous fiscal year (Q1 FY25). Growth is increasingly app-led: approximately 2.0 billion payments were conducted via mobile banking and wallet applications in the same quarter, accounting for roughly 81 percent of all digital payments and processing PKR 33.7 trillion in value. This scale signals a structural shift. Digital payments in Pakistan are no longer confined to pilots, early adopters, or urban niches. They are embedded across banking, branchless banking, and consumer-facing platforms nationwide. The country has successfully crossed the threshold from experimentation to mass usage.

What this scale implies, however, is a change in the nature of the challenge. As digital channels mature, the central question is no longer whether people can transact digitally, but whether they choose to do so consistently in daily life.

Where Value Actually Flows?

While digital channels now dominate transaction counts, retail payment value tells a more nuanced story. An examination of transaction values by channel shows that large-ticket economic activity continues to be concentrated in cash and branch-based instruments, even as digital channels scale rapidly in volume. This divergence reflects that Pakistan’s cashless challenge is no longer about access or adoption, but about shifting where and how value is ultimately transacted within the economy.

This distribution underscores a critical insight. While digital channels are widely used, a significant share of economic value continues to move through cashheavy, assisted, or branch-based channels. Digital payments are frequent, but often low-ticket. Cash remains dominant where transaction sizes are larger, usage certainty is required, or assistance is preferred.

Pakistan’s cashless challenge is no longer about onboarding users to digital platforms. It is about converting digital inflows into sustained digital usage, especially for everyday spending and high-frequency transactions.

What needs attention now?

Pakistan has laid strong foundations for a cashless economy through the rapid expansion of digital payment infrastructure and usage. What remains are challenges related to end-to-end digitisation of user journeys, uneven acceptance in everyday commerce, last-mile infrastructure readiness, and the trust and confidence needed for citizens and merchants to make digital payments the default. Until these gaps are addressed together, cash will continue to coexist alongside digital channels rather than being displaced by them. Importantly, this is not a single-issue constraint. It is the combined effect of structural gaps and behavioural responses that reinforce one another.

55.4 trillion PKR

Digital Channels

Mobile Banking Apps

PKR 29.1 trillion

Internet Banking

PKR 11.5 trillion

Branchless Banking Wallets

PKR 4.4 trillion

Card POS & Ecommerce

PKR 688 billion

110.4 trillion PKR

OTC Channels

Bank Branch Transactions

PKR 109.5 trillion

Branchless Banking Agents

PKR 0.9 trillion

Challanges holding back the “Digital Default”

End-to-End User Journeys Are Not Yet Fully Digital in Practice

In many cases, funds enter the system digitally through salaries, pensions, social protection transfers, or remittances, but are withdrawn soon after credit. Limited digital familiarity among certain user segments and continued reliance on cash for everyday household spending prevent these inflows from remaining digital through to use. Person-to-government payments such as utility bills and challans are increasingly available through digital channels, yet adoption remains uneven. Many users continue to revert to cash or OTC methods, particularly where assistance, certainty, or familiarity is perceived to be higher.

Acceptance in Everyday Commerce Remains Inconsistent

Digital payment acceptance is not yet universal across routine consumption categories. Small retail, services, transport, and fuel outlets do not consistently offer reliable digital options. Acceptance may vary by location, payment type, or merchant capability. As a result, cash continues to function as a safety net. Even digitally capable consumers often carry cash because they cannot be certain that a digital option will be available or accepted when needed.

Last-Mile Readiness and Operational Frictions Reduce Practicality

Cashless payments depend on reliable connectivity, power, devices, system uptime, and the availability of multiple transaction modes such as QR codes. In addition, processing and settlement buffers, where confirmations are delayed or funds are not immediately usable, reduce practicality for both merchants and consumers. Where infrastructure reliability or transaction finality is inconsistent, particularly outside core urban areas, digital payments become less dependable and cash remains the fallback.

Trust and Usage Habits Are Still Forming

Even where digital options are available and accepted, many users cash out immediately after receiving funds. Concerns around failed transactions, delayed settlements, unclear reversals, limited transparency, and perceived risk discourage users from keeping value digital. For digital payments to become the default, they must feel safe, simple, predictable, and timely. Trust is not only a regulatory issue; it is a daily user experience outcome.

What Is Already Working: Momentum to Build On

At the same time, there is clear momentum to build upon. Policy direction is aligned, core payment rails are scaling, merchant onboarding is expanding, and publicsector digitisation initiatives are underway. The ecosystem is moving decisively from policy intent to execution. This momentum provides a strong platform for the next phase. The challenge now is not acceleration alone, but conversion.

How to Make Digital the Default

Convert digital inflows into digital spending:

Focus on high-frequency journeys (pensions, salaries, social protection, remittances, routine P2G) so digital receipts are retained and used digitally rather than immediately cashed out, supported by assisted onboarding and simple user experiences.

Make digital acceptance predictable in daily commerce:

Ensure reliable acceptance across small retail, transport, fuel, and services by scaling low-cost QR solutions, merchant enablement, and minimum reliability standards at checkout.

Reduce last-mile friction and improve usability:

Strengthen uptime, connectivity resilience, and interoperability, while reducing settlement and processing buffers and improving transaction status transparency.

Build trust through felt consumer protections:

Deliver clear dispute resolution timelines, predictable reversals, transparent charges, and strong anti-fraud controls to increase confidence and reduce cash-out behaviour.

Align incentives and enforcement to shift behaviour:

Combine targeted rewards, fee discounts, and loyalty schemes with calibrated disincentives for excessive cash reliance to nudge sustained digital usage without backlash.

Conclusion

Pakistan’s cashless agenda has reached an important inflection point. Digital payments have achieved scale and visibility across the economy. The task ahead is to ensure that this scale translates into everyday default usage. If pursued together, targeted improvements in user journeys, acceptance reliability, last-mile readiness, trust, and behavioural incentives can move Pakistan from strong digital foundations to a cashless ecosystem where digital is the normal choice and cash becomes the exception.

About Us

With over three decades of management consulting experience across telecom, cloud, and digital infrastructure, VTT Global advises governments, investors, and large enterprises on data-centre strategy and transformation. Drawing on hands-on delivery across end-to-end market strategy, commercial feasibility, and infrastructure planning in South Asia, the Middle East, and the United States, we bring a practical, executionaware perspective to data-centre development and investment decisions.

Why VTT Global?

- Global footprint with local expertise

- 200+ subject matter experts

- 260+ professionals worldwide

Our Focus Industries

- Technology, Media and Telecom (TMT)

- Energy, Climate & Sustainability

- Public Policy and Governance